Consider a hypothetical multinational kleptocratic enterprise as a basic problem in business management.

The business process at stake is commodification, in its rawest form, unburdened by risk issues related to regulatory compliance that bedevil similarly-scaled enterprises. The Russian occupation of Ukraine creates a business-friendly environment for Russian kleptocratic structures who convert Ukrainian grain, metal, and people into resources for economical exploitation.

The market for this type of enterprise in stolen commodities is global, and although it is smaller than it used to be, it is still quite significant and easy to access. No country is going to question very closely where their grain is coming from if they have starvation issues inside their own borders; coal doesn’t know nationality, and if you “steal” Ukrainian coal and mix it with Russian coal, then there’s basically no way of telling what’s what, even if you sell it back to Ukraine.

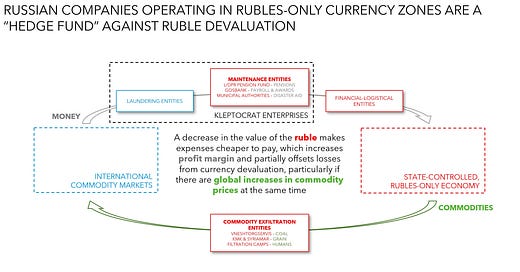

The interesting thing about this structure, if you think about it, is that if you are a commodity-extraction entity owned by Russians with operations in places where only rubles can be used, you have a “baked in” profit center: the difference in value between the currency that you earn money in, and the currency that you pay expenses in.

You’re capable of making money off of both ends, if you play it right, because your earnings before interests, taxes, depreciation and amortization (EBITDA) are in foreign currency - US dollars, euros, hryvnia (Ukraine’s currency) - while your expenses are in rubles.

So, if the value of the ruble goes down, that has effects on you like any other Russian company, presumably. For one, it gets much, much harder to afford anything from overseas (if you can even acquire it, with sanctions going) because your capital will be in rubles, which will be worth much less; this also limits your expansion.

On the flipside, however, your products will also be much, much more attractive to international buyers (if they can even access your product, because of sanctions) because they will be comparatively cheaper, because those prices will be in rubles, which are, again, worth less than they used to be.

If the basic products you are selling as a hypothetical Russian kleptocrat billionaire are also selling at a premium - because of a crisis that you may have artificially induced, even - then you’re making an even more heightened profit from a system that’s designed to actually punish you.

As a business cycle, I think it looks like this: up to a limit comprised by the total cost of expenses and overhead, it is possible to offset damage to liquid capital’s value from currency devaluation, by diminishing the cost of the basic commodification process.

So, if I was in Serhiy Kurchenko’s shoes right now, all the savings I have in rubles are worth a lot less than they used to be. On the other hand, the money I’m making from owning a coal company - VNESHTORGSERVIS, or VTS - that sells its products on the European and international market for foreign currency is much higher than it used to be. And all my expenses inside the separatist territories of Ukraine, where VTS operates, are much, much cheaper for me to pay, as well.

Similarly, if I was in a Russian oligarch’s shoes right now, looking at potential opportunities for exploitative commodification opening up in occupied Ukraine… I’d be looking very, very hard at recent “economic integration” activity in the Kherson oblast, and the south of Ukraine generally, as areas to set up a durable commodity-extraction process like this, if I didn’t already own one.